The Centers for Medicare and Medicaid Services (CMS) has released their Final Rule for 2022, and this year’s update is a mix of good and bad news. In a recent webinar, our founder, Jerry Henderson (PT), sat down with compliance specialist Nancy Beckley (MS, MBA, CHC) to discuss the highlights from the 2022 Final Rule. Here are all the major changes coming in the new year, and information on where you can learn more.

How to prepare for the assistant modifier

Arguably the hottest topic of discussion is the assistant modifier. Rehabilitative therapists have been required to report the modifier CO or CQ (when appropriate) since 2020. But beginning January 1, 2022, any services provided at least “in whole or in part” by an assistant will see a 15% reduction in the Medicare reimbursement value.

Depending on how often you use assistants at your clinic, that 15% reduction is a deep cut in revenue. Our hosts shared their opinion, that for larger clinics the “extensive use of assistants [is] not likely sustainable with Medicare.” However, that doesn’t mean you should get rid of assistants. Instead, do a thorough look at your practice and determine how you can reallocate services to minimize the impact.

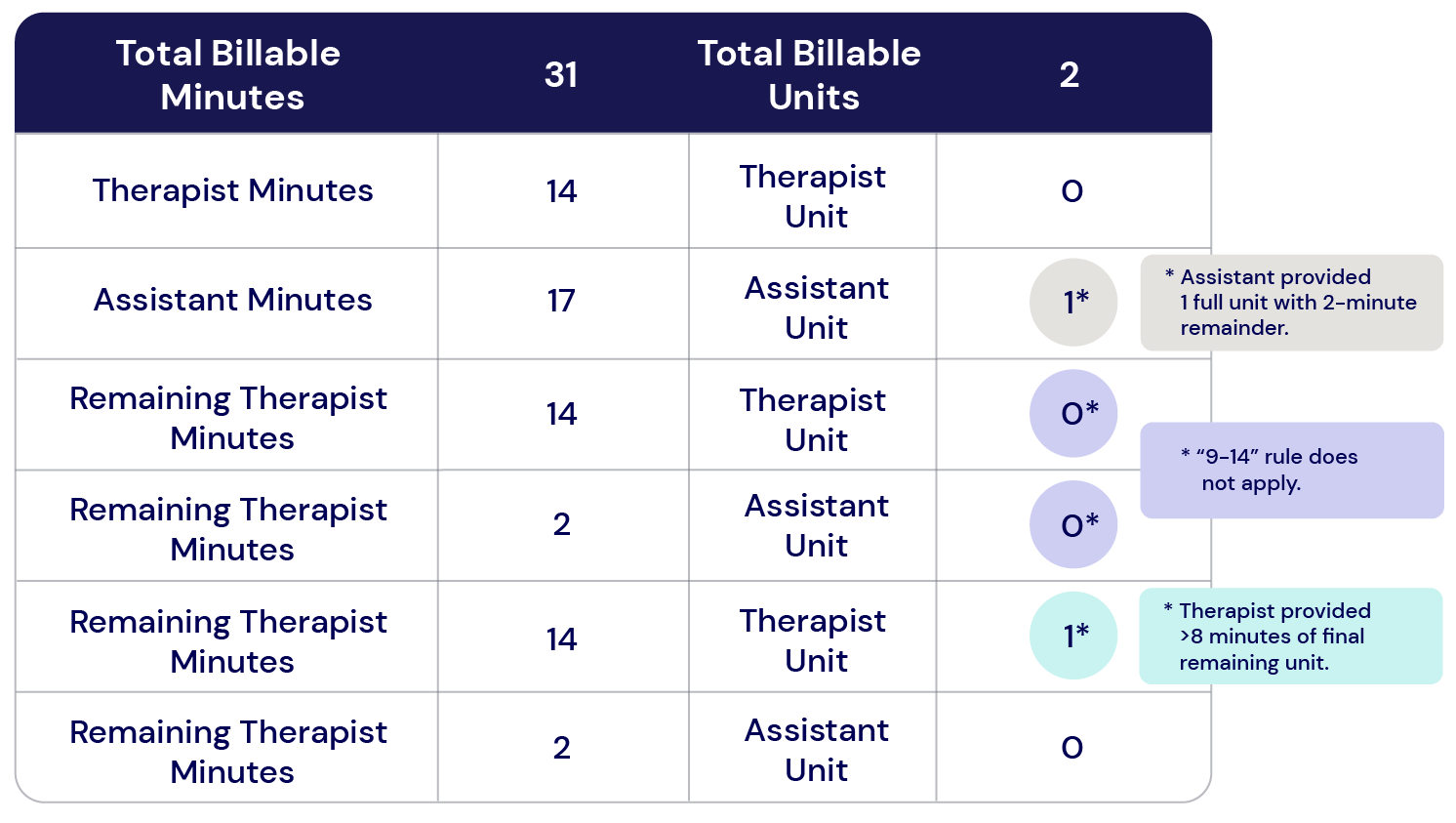

However, understanding how to apply the assistant modifier to line-item services has led to a lot of confusion for billers and providers—especially if there are two line items of the same code, one with the modifier and one without. While CMS offered a couple of examples of how to apply the assistant modifier to timed units, we’ve provided a simpler, step-by-step method that Jerry shared with our audience:

- Step 1: Assign whole, 15-minute units to the assistant and therapist.

- Step 2: Calculate the remaining billable minutes for any split-timed services. If there are two units remaining, assign one unit to the therapist and one to the assistant if each provided 9-14 minutes of those billable services.

- Step 3: Assign the remaining billable units to either the provider or assistant and if the therapist provided at least 8 minutes of the final unit, do not bill with the modifier.

When untimed services are provided by both an assistant and therapists during the same visit, the assistant modifier is required when the assistant provides more than 10 minutes of the service.

Below is an example using this step-by-step process for a total of 2 billable units of service:

As for documentation, Nancy notes that CMS has not released any new rules regarding how to document the assistant modifier. But based on Nancy’s compliance experience, documenting the following items can really help in supporting the claim in the case of a Medicare audit:

- Who performed the service?

- What was the service?

- Who supervised the service?

- What supervision rules were required? (example: telehealth requires different supervision rules and styles than in-person)

The 2022 conversion factor and therapy threshold

As is tradition, CMS has also updated their conversion factor and the therapy threshold for Medicare Part B beneficiaries.

The therapy threshold for 2022 increased by $40 from 2021, resulting in:

- $2,150 for PT and SLP services, combined.

- $2,150 for OT services.

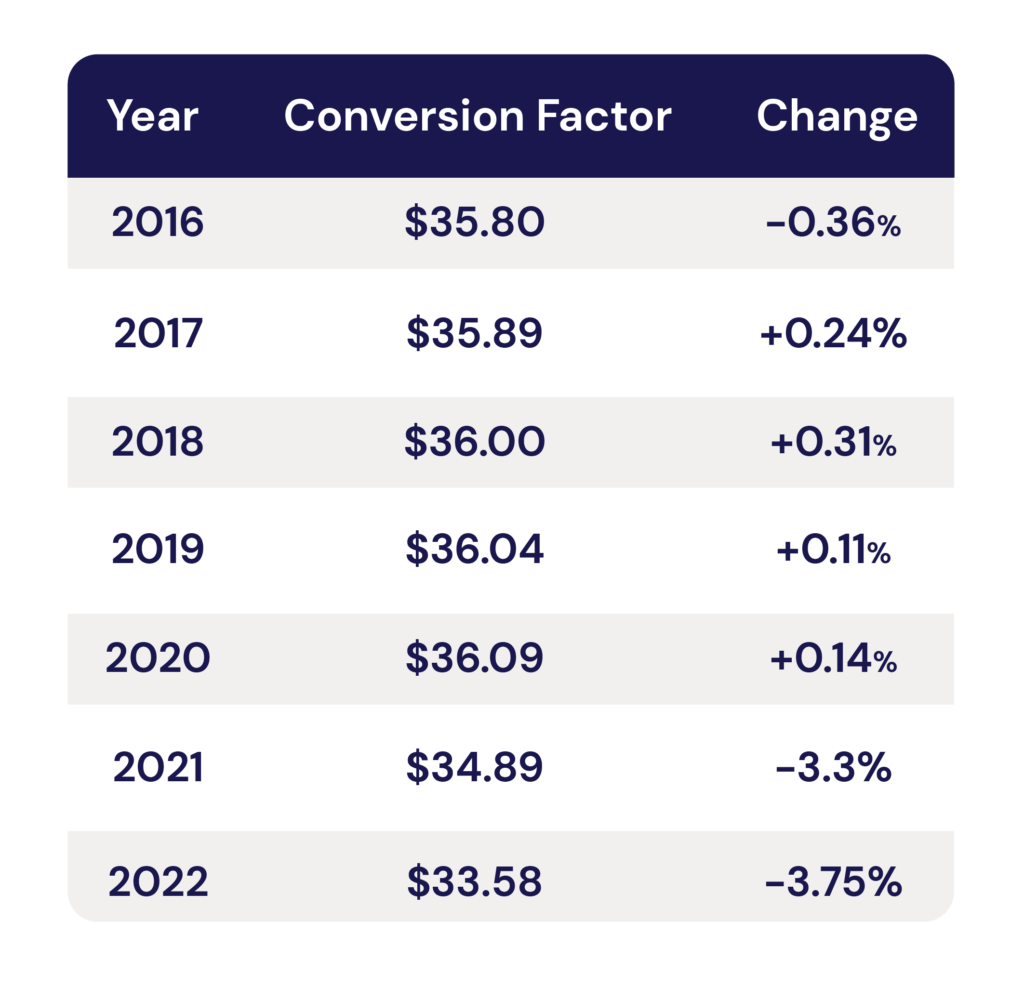

The conversion factor, however, has decreased. The conversion factor is an element of the fee schedule that is multiplied by the total RVUs for a given procedure code. Below is a chart showing the changes the conversion factor has gone through over the years. This year, the decrease is a significant -3.75%, or -$1.31 per procedure price change.

New Remote Therapeutic Monitoring (RTM) codes

Now, for some good news. RTM codes provide a new opportunity for increasing revenue with Medicare reimbursements. According to the Final Rule (p. 352-353), RTM codes can be patient-reported, and are defined as:

“RTM codes monitor health conditions, including musculoskeletal system status, respiratory system status, therapy (for example, medication) adherence, and therapy (for example, medication) response, and as such, allow non-physiological data to be collected.”

Details are still fresh on these new codes, so there could be changes as the policy is rolled out in the new year.

What are RTM codes?

RTM codes are available for remotely monitoring a patient’s health condition, including their musculoskeletal system status and respiratory system status, and collecting non-physiological data from the patient via an FDA-approved device or app (like Keet Health). RTM codes are available to PTs, OTs, and SLPs (and assistants under therapist supervision), and can be billed for reimbursement using new CPT codes.

Below, we’ve written out each code’s description, and what other Medicare rules may apply to the codes:

| CPT code | Description | Threshold applies? | MPPR applies*? | De minimis standard applies? |

|---|---|---|---|---|

| 98975 | Remote therapeutic monitoring (eg, respiratory system status, musculoskeletal system status, therapy adherence, therapy response); initial set-up and patient education on use of equipment | Yes | No | Yes |

| 98976 | Remote therapeutic monitoring (eg, respiratory system status, musculoskeletal system status, therapy adherence, therapy response); device(s) supply with scheduled (eg, daily) recording(s) and/or programmed alert(s) transmission to monitor respiratory system, each 30 days | Yes | No | No |

| 98977 | Remote therapeutic monitoring (eg, respiratory system status, musculoskeletal system status, therapy adherence, therapy response); device(s) supply with scheduled (eg, daily) recording(s) and/or programmed alert(s) transmission to monitor musculoskeletal system, each 30 days | Yes | No | No |

| 98980 | Remote therapeutic monitoring treatment, physician/other qualified health care professional time in a calendar month requiring at least one interactive communication with the patient/caregiver during the calendar month; first 20 minutes | Yes | No | Yes |

| 98981 | Remote therapeutic monitoring treatment, physician/other qualified health care professional time in a calendar month requiring at least one interactive communication with the patient/caregiver during the calendar month; each additional 20 minutes | Yes | No | Yes |

*Because all of these codes are deemed “sometimes therapy” by CMS, they are not subject to the Multiple Procedure Payment Reduction (MPPR).

Get your clinic fully prepared with our 2022 Medicare Guide

Every year when a new Final Rule comes out, there’s always a lot of new information to take in. But do not fear—Clinicient is here to help! You can take a deeper dive into the Medicare Final Rule changes for 2022 with our new guide. Learn more about the changes, plus:

- Nancy’s tips on audit-readiness

- The importance of clinic data collection

- And Nancy and Jerry’s FAQ on the 2022 updates

Comments